Please note that Premia does not provide investment advice, and nothing herein should be construed as such. Anyone considering trading or holding derivatives or crypto assets should be aware that the risk of loss can be very high, and it is upon each individual to seek advice from an appropriate professional advisor.

TL;DR: Chippity Chop, Is This Santa Rally Real?

BTC ATM IV

1W: 41.81%

1M: 42.53%

3M: 44.32%

6M: 46.40%

Index Price: $87,400

DVOL: 44.97

ETH ATM IV

1W: 62.89%

1M: 64.44%

3M: 66.21%

6M: 67.19%

Index Price: $2,461

DVOL: 67.24

Marty’s Thoughts / Recap

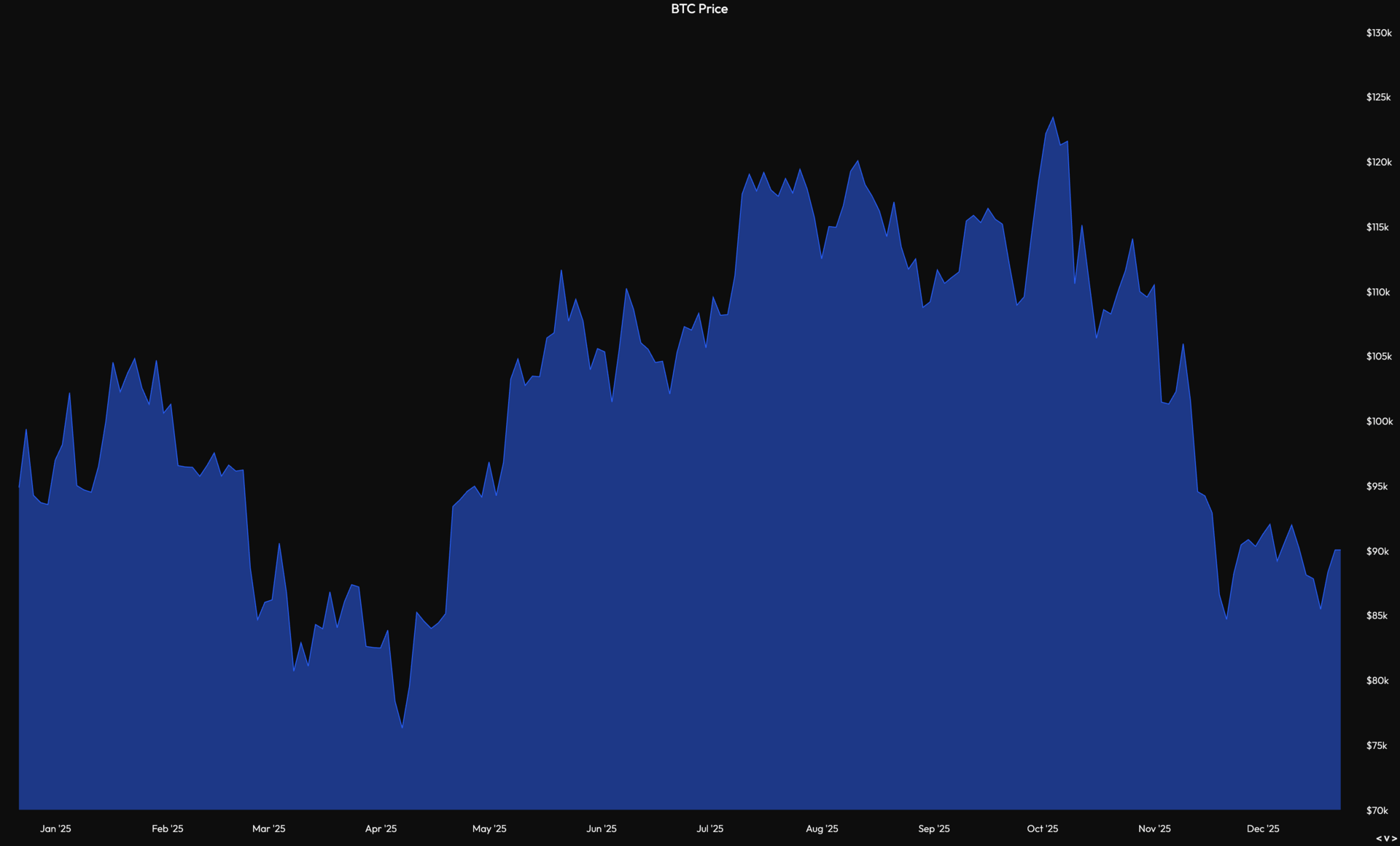

1 Year Line Charts — BTC

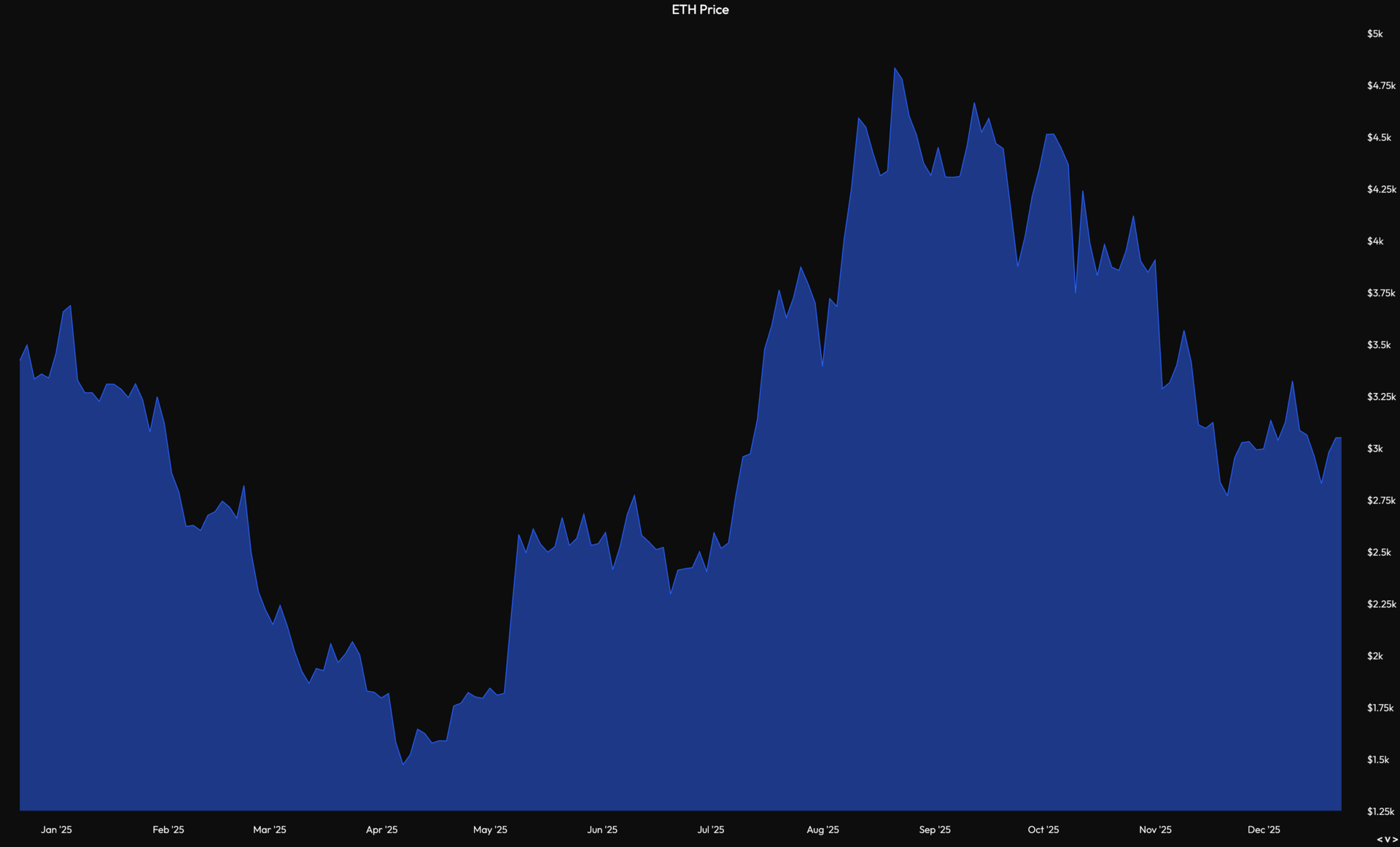

1 Year Line Charts — ETH

A Look at 2025

When you zoom out and step away from the candle chart, the picture becomes uncomfortably clear. We're trading at the same price, actually lower, than we were a year ago. Bitcoin closed 2024 at approximately $93,000 and currently sits around $89,000 as of now. The majors have pulled back significantly from their highs and are down bad from earlier peaks in the year. Let's just start by saying the price action tells a story that doesn't match the narrative we've been fed.

Institutional Accumulation

The majors saw unprecedented institutional buying despite muted price discovery. Every fund, institution, Strategy, Bitmine, and the entire institutional roster fired clips into our coins. Strategy alone brought their total holdings to 671,268 BTC worth approximately $60 billion. That's over 3% of all Bitcoin that will ever exist.

Bitcoin ETFs launched in January 2024 and pulled in tons of flow, breaking into the top 20 funds by flows in their debut year. Yet this massive institutional accumulation didn't translate to the parabolic price action many expected. Note: Yes, we hit 120's, but we didn't see anything near parabolic movement (like up to 200k+) which everyone was calling for.

Sure, there was a massive transfer of wealth as OG wallets capitulated to institutions, but I'm not convinced this is the bullish rotation we thought we were getting. The price action tells a different story. We hit an all-time high around $126,000 in Octber, then promptly sold off to where we are now. The goal as an OG bitcoiner was to sell your coins to institutions, the real OGs seem to have remembered and unloaded billions to institutional buyers.

Post 10/10… Shoutout Ping!

Post 10/10, most funds I've spoken with have taken a step back, sent people on holiday, and won't be back full-time until the new year. This leaves order books thin and spreads wide heading into year-end. Classic.

The ETF impact created an interesting paradox. While spot Bitcoin ETFs saw massive inflows, the derivative markets told a more complex story. Funding rates fluctuated wildly throughout the year, and open interest reached new highs, yet volatility actually compressed relative to traditional assets. We became less chaotic than equity markets on certain days, which is either maturation or a warning sign, depending on your perspective.

Exchange volumes migrated significantly, with centralized exchanges still dominating but DEX volumes growing substantially. The fragmentation in crypto derivatives markets continued, with hundreds of different venues creating pricing inefficiencies that market makers can navigate, but leaving retail struggling. We really need to fix this fragmentation in crypto, or else TradFi venues will just band together, create their own railways, and leave all crypto native users and platforms in the dust!

The Political Flip

Crypto went from regulatory hell to campaign talking point in 2024. Under Gary Gensler's SEC leadership, the agency took an aggressive enforcement-driven approach, instead of just dropping a new rule book, initiating 125 cryptocurrency-related enforcement actions and securing billions in remedies in fiscal year 2024 alone.

Gensler's broad interpretation of the law led to lawsuits against multiple high profile companies. His stance was clear: most crypto assets are securities, and the industry's failures stem not from unclear rules, but from refusal to follow existing ones.

Then came the election. Donald Trump's victory in November 2024 shifted everything. Trump, who had threatened to fire Gensler "on day one," ushered in a new era. Gensler resigned on January 20, 2025, the day Trump took office. The new administration's approach is to prioritize innovation over enforcement, with Paul Atkins, a fella with a much more crypto-friendly stance.

I would say that post election, crypto became wild again. Meme coins were deemed LEGAL! Enforcement actions dropped, but we never saw the clear regulatory guidelines and regulatory sandboxes for companies to continue to build in parallel with government and follow regulations. It all kinda became free game again, creating a crypto gold rush for a few months, which has died down since.

Internationally, MiCA (Markets in Crypto-Assets Regulation) took effect in the EU, with Circle becoming the first MiCA-licensed stablecoin issuer in July 2024. Various Asian jurisdictions continued developing frameworks, but the US remained in regulatory limbo for most of the year.

The US established a crypto working group, appointed David Sacks as Crypto Czar, and announced the creation of “reserves,” which ultimately amounted to consolidating crypto already held by various agencies under the Treasury’s oversight. While these developments are positive steps in the right direction, they fall short of what many expected. There was anticipation that the USG would actively acquire BTC for the reserve and introduce clear, comprehensive regulatory guidelines.

Bitcoin Succeeds, Ethereum Disappoints

Ethereum ETFs launched in July 2024, approximately six months after their Bitcoin counterparts. The anticipation was high, but the reality disappointed. While Bitcoin ETFs were pulling billions, Ethereum ETFs struggled out of the gate.

The divergence makes sense. Bitcoin's narrative as "digital gold" resonates with institutional treasurers looking for an inflation hedge. Ethereum's value proposition as a "world computer" and DeFi infrastructure layer is more complex and harder to pitch to traditional finance suits who just want simple exposure.

All year long, really juicy basis kept funds and traders coming back to farm carry. These participants typically buy the spot ETF and sell futures against it, creating inflows while remaining largely market-neutral through a hedged position. The key risk to watch out for is what happens when that basis compresses or turns unattractive and those same traders unwind their positions.

Is Crypto Just Stablecoins?

If there's one major success story in crypto for 2025, it's stablecoins. The total stablecoin market capitalization sits at $300+ billion today.

Tether reached a record supply of $187 billion, maintaining approximately 60% market dominance, which is an insane stat.

The stablecoin growth wasn't just about crypto trading. Real world adoption accelerated. PayPal maintained its PYUSD. Circle partnered with MoneyGram. Adoption in high remittance regions like Latin America, Africa, and Southeast Asia surged, with stablecoins offering faster, cheaper alternatives to traditional remittance rails.

This is telling. Stablecoins are the only crypto product with genuine product market fit at scale. They solve real problems for real users. Meanwhile, most other crypto assets are still searching for sustainable utility beyond speculation.

I'll leave you with a question: Is crypto's future just stablecoins?

Volatility Comparison… Boring

Crypto's historic selling point was volatility. We were the chaos trade, the place where degenerates could make or lose fortunes in days. In 2024, that changed.

Bitcoin's realized volatility actually dropped below that of several major tech stocks at various points throughout the year. There were days when Nvidia, Tesla, and other Mag 7 stocks experienced larger percentage swings than BTC. The S&P 500 posted several multi percent moves that would have been considered extreme just years ago.

This volatility compression is a double edged sword. It suggests maturation and legitimacy, which institutions love. But it also removes the primary appeal for speculators who came to crypto for asymmetric risk reward profiles. When Bitcoin trades more like a tech stock than digital gold with optionality, what's the pitch? Who is buying or trading it at that point?

Tax Loss Harvesting and Year-End Dynamics

We're seeing funds engage in year end tax loss harvesting, booking losses to offset gains elsewhere. This is rational behavior, but it adds selling pressure at exactly the wrong time. Funds are locking in losses on coins and memecoins that got obliterated, using those losses to shield gains from their equity or fixed income books.

This creates predictable year end seasonality. Q4 typically sees funds reduce risk, book losses, and go into hibernation mode. January often brings "new year, new money" flows, so we await the new year. What is interesting is we started to see this type of flow in early November, instead of December, people were front running this year.

The Capital Allocator's Dilemma

Now put on your capital allocator hat and ask yourself: Why deploy capital into crypto in 2025?

Majors are down year over year, and down significantly from their peaks. Alts and memes got sent to Hades. Stablecoins are the only product with genuine traction, but that's not exactly a ringing endorsement for risk assets.

Meanwhile, equities across every sector posted spectacular returns in 2024. The S&P 500 delivered approximately 17%, with tech single names up even more.

If you're managing a book, the opportunity cost argument writes itself. Why take crypto's regulatory uncertainty, custody headaches, and operational complexity when you can just buy indices or single name stocks and sleep well?

The only counterargument is positioning for what comes next. If you believe the regulatory environment improves under Trump, if you think institutional adoption continues accelerating, if you view this as a setup phase for a 2026 run, then current prices offer entry points. Maybe Every Dip Is A Gift? But that requires conviction in a narrative that hasn't fully materialized.

What Broke This Year

Let’s be honest about the failures. We didn’t see major exchange blowups, like FTX in 2022, but we did see plenty of protocol exploits, rug pulls, and projects that simply faded to zero. The memecoin casino burned billions in retail capital. NFT markets remained largely dead outside of niche use cases, such as CryptoPunks being added to the permanent collection of MoMA, announced just yesterday.

The promised institutional DeFi revolution didn't materialize. Major banks and asset managers talked about tokenization and blockchain infrastructure, but actual deployment remained limited. BlackRock's BUIDL fund and similar tokenized treasury products gained traction, but we're still far from global adoption.

Some narratives died quickly. The "Ethereum killer" thesis weakened as multiple chains did anything but displace Ethereum. The metaverse narrative remained zero. Web3 gaming continued to struggle with actual fun gameplay, or any playable game at all! Most RWA tokenization projects are still confined and remain in pilot phases.

Not looking good, fellas.

Looking Forward

We're heading into 2025 with a more crypto-friendly political environment, maturing infrastructure, and clear institutional interest. But we're also carrying the baggage of unfulfilled promises, regulatory uncertainty despite political shifts, and a market structure that still favors insiders over retail.

The setup could be promising. ETF adoption should continue growing. Regulatory clarity might actually arrive. Stablecoin legislation could unlock new use cases. But "could" and "might" aren't certainty, and this market has disappointed too many times to take anything for granted.

Wrap-Up

So what do we have? Institutional accumulation that hasn't translated to price discovery. Retail that's been beaten into submission. A risk off setup heading into the holidays. Stablecoins working brilliantly while everything else searches for sustainable product market fit. And equity markets that have been up only all year, making the opportunity cost of crypto allocation extremely high.

I'll be taking a break over the next few weeks, and we'll reconvene in the new year with a proper forward looking piece on what 2026 might actually hold. For now, enjoy the holidays, keep your position sizes reasonable or go on holiday yourself, and remember that surviving to trade another day is often the best strategy.

Until next year, pimps.

Visa Stablecoin Dash: https://visaonchainanalytics.com/

Defillama Stablecoin Dash : https://defillama.com/stablecoins

Thank you to all the readers who make this newsletter possible, we are sitting at about 4000+ email sign ups, and thousands of readers every 2 weeks. As for the Options Talk Show, if you or someone you know wants to be a guest, feel free to DM me, we are booking out February 2026!

Note: Email sign ups get the newsletter 20ish minutes earlier.

Recap:

Are Stablecoins The Future Of Crypto?

Every Dip Is a Gift?

End Of Year Wrap-Up

Trade on Kyan: https://alpha.kyan.blue/

Join The Marty Community Telegram: https://t.me/optionswithmarty

Mind you there is never a paid group, all information is free and we will never ask you for money. The Telegram is always free and provides a community for people to chat and learn.

What Does Kyan Mean for Crypto Options?

Kyan is a significant upgrade for anyone trading decentralized derivatives.