Please note that Premia/Kyan does not provide investment advice, and nothing herein should be construed as such. Anyone considering trading or holding derivatives or crypto assets should be aware that the risk of loss can be very high, and it is upon each individual to seek advice from an appropriate professional advisor.

TL;DR: 1) What

BTC ATM IV

1W: 53.96%

1M: 44.86%

3M: 43.82%

6M: 45.70%

Index Price: $78,280

DVOL: 46.63

ETH ATM IV

1W: 81.54%

1M: 66.24%

3M: 63.36%

6M: 64.55%

Index Price: $2,344

DVOL: 65.46

2) Happened

For those from the FTX days, you'll remember the infamous "1) What 2) Happened" tweets from Sam. Well, we just witnessed another implosion over the weekend. Global uncertainty is near all-time highs, and crypto is in full risk-off mode. The Digital Lead Thesis has come to fruition… we cannot catch a bid to save our lives.

Markets are in shambles. Bitcoin is hovering around $77,000 after briefly touching $75,000 over the weekend—its lowest level since April 2025—and a brutal 40% drop from October's $126,000 peak. Nearly $800 billion in market cap has evaporated since then, knocking BTC out of the global top 10 assets. This weekend's crash wiped out hundreds of billions from the total crypto market in thin weekend liquidity conditions that amplified the carnage.

Ethereum got hit even harder, plunging to the low $2,000s, with some reports showing ETH down over 25% in recent days. Institutional players like Tom Lee's BitMine Immersion are sitting on $6 billion in paper losses on their ETH positions. Altcoins are in an absolute bloodbath. SOL dropped below $100, XRP is down over 20%, and the broader market is showing textbook signs of capitulation.

The Abu Dhabi-Trump Crypto Deal

Some news came out of the woodwork regarding World Liberty Financial and the UAE, let’s review…

The UAE's national security adviser, and brother of the UAE's president, bought a stake in Trump's World Liberty Financial for $500 million just four days before Trump's second inauguration in January 2025. Eric Trump signed the deal. Of the initial $250M payment, $187 million went directly to Trump family entities, and $31 million to Steve Witkoff's family (Trump's Middle East envoy and World Liberty co-founder).

Just months later, the Trump administration approved a deal allowing the UAE to import 500,000 of NVIDIA's most advanced AI chips per year through at least 2027.

How is any of this legal, you might ask? I'm also dumbfounded.

A perfect storm. Kevin Warsh's Fed nomination spooked markets about tighter monetary policy ahead. The recently surging dollar is crushing all risk assets (two weeks ago, it was in freefall). Geopolitical tensions with Iran are escalating, and gold and silver just had their own historic crashes (silver down 26% in a session!!!). The correlation play is dead, and nothing is safe right now.

Adding fuel to the fire, options traders have completely flipped sentiment. The $75,000 put is now as popular as the $100,000 call was during the micro bull run we had at the beginning of January. That's a total regime change.

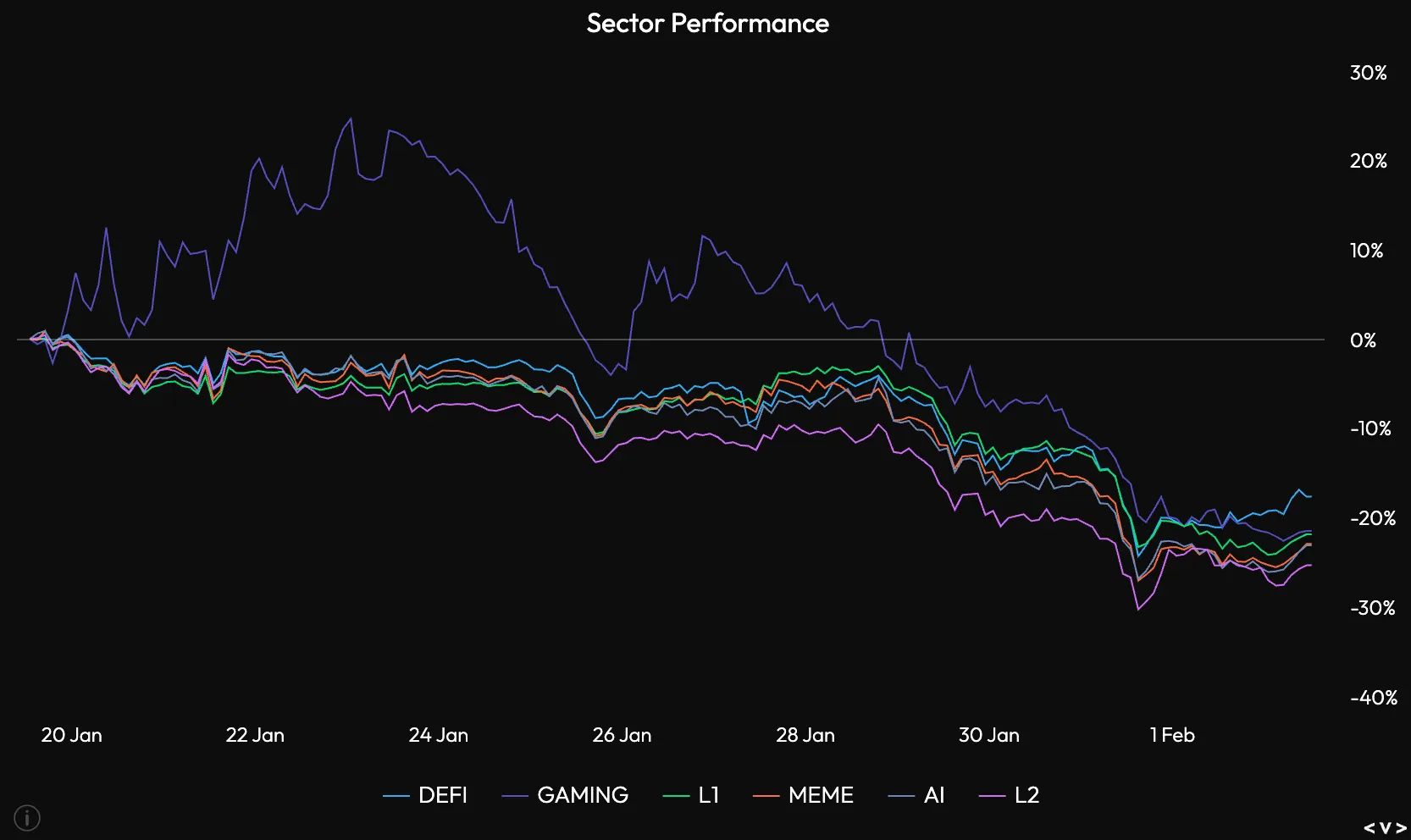

Sector Performance

Last newsletter we hinted at that it was only dino coins pumping, and that it was concerning… Now, looking back we should have max shorted everything on 1000x leverage. As for sector returns the past 2 weeks, every basket it negative.

OHHH, IT WENT TO ZERO! Just look at the carnage… Everything is bleeding red except for HYPE and CC (which, honestly, I have no clue what CC even is). HYPE is green because Hyperliquid is literally printing money right now while the rest of the market gets obliterated. ETH is down 26%, SOL is down 21%, BNB is down 16%, and XRP is down 17%. Even the smaller caps are getting absolutely crushed.

This is what pure capitulation looks like. When you see a sea of red this deep and this quick… it means there are no buyers left—just forced sellers and liquidations cascading through the system. Straight to zero.

Note: Usually when I write a bearish newsletter, it's the absolute pico bottom. If anyone has any data, I’m interested to know… but I’m gonna say it’s 100%. My Editor-in-Chief Weka knows—he just counter-trades me every time.

Wrap-Up

Look, we've seen this before: FTX, Terra/Luna, the March 2020 COVID crash, the April tariff nuke, and plenty more. Every time, it feels like the end—and every time, the market finds a floor.

The difference now is we're dealing with multiple macro headwinds at once: geopolitical chaos, a strengthening dollar, and institutions sitting on billions in losses. Liquidation events like Garret getting wiped typically mark local bottoms, but this could be a longer grind than previous cycles. We've recovered modestly from last night's lows, but don't mistake a dead cat bounce for the green light.

That said, if you're in for the long haul, these capitulation events are historically where fortunes are made. BTC under Saylor's basis, ETH in the $2,000s, alts down 80%? For patient capital with a multi-year horizon, this might not be a bad time to start nibbling. NFA, but the best entries usually feel the worst.

Buckle up, pimps, and manage your risk.

Note: Email signups get the newsletter 20ish minutes before.

Charts from Velo Data: https://velodata.app/

Twitter: https://twitter.com/VeloData?s=20

Recap:

Crypto Went To ZERO

Digital Lead it was indeed

Shady inner workings between Trump's World Liberty and UAE exposed

Join The Marty Community Telegram: https://t.me/optionswithmarty

Mind you there is never a paid group, all information is free and we will never ask you for money. The Telegram is always free and provides a community for people to chat and learn.