Please note that Premia does not provide investment advice, and nothing herein should be construed as such. Anyone considering trading or holding derivatives or crypto assets should be aware that the risk of loss can be very high, and it is upon each individual to seek advice from an appropriate professional advisor.

TL;DR: Maybe We Should’ve All Just Stayed on Testnet

BTC ATM IV

1W: 53.60%

1M: 49.86%

3M: 47.90%

6M: 48.77%

Index Price: $86,213

DVOL: 52.81

ETH ATM IV

1W: 73.73%

1M: 71.27%

3M: 70.96%

6M: 71.13%

Index Price: $2,822

DVOL: 71.68

Note: As I am writing this this morning, we continue our freefall. ETH $2,729, BTC $84,300.

The Kyan Trading Competition: Stage 2

As we wrap up Stage 1 of Kyan test net Trading competition, I want to give a shoutout to all the fellas that stayed online, trading, and providing feedback while the Kyan team was working out a bunch of kinks and bugs!

It was a wild one, around 3,000 people signed up and participated during the first 2 weeks. If you tried out Kyan in Stage 1 and weren't impressed I want you to come try out Stage 2 and provide me with some feedback! What do you have to lose? It's free!

Below are some of the main highlights of the prizes in Stage 2! Yes, you read that right… Real cash prizes!

Stage 2 is launching today at 7pm UTC / 2pm EST

25k USDC prize pool

800,000 Krystals distributed

I have some alpha for our readers, this stage is all about PNL. User accounts will be reset today, and everyone starts Stage 2 on a level playing field. If you participated in Stage 1, the winners will be announced this week and the leaderboard will be live!

TL;DR: The trading comp is on testnet, there are cash prizes, it’s free to participate, and the team is available and listening to any and all requests 24/7.

Hidden alpha: No one is running a taker bot (yet) that picks off bad pricing, I was able to manually pick off a few peoples insane stale and totally the wrong price, off by thousands of dollars. These kind of easy pickings can easily inflate and boost your PNL for Stage 2. (Marty doesn’t qualify for rewards)

Marty's Thoughts / Recap

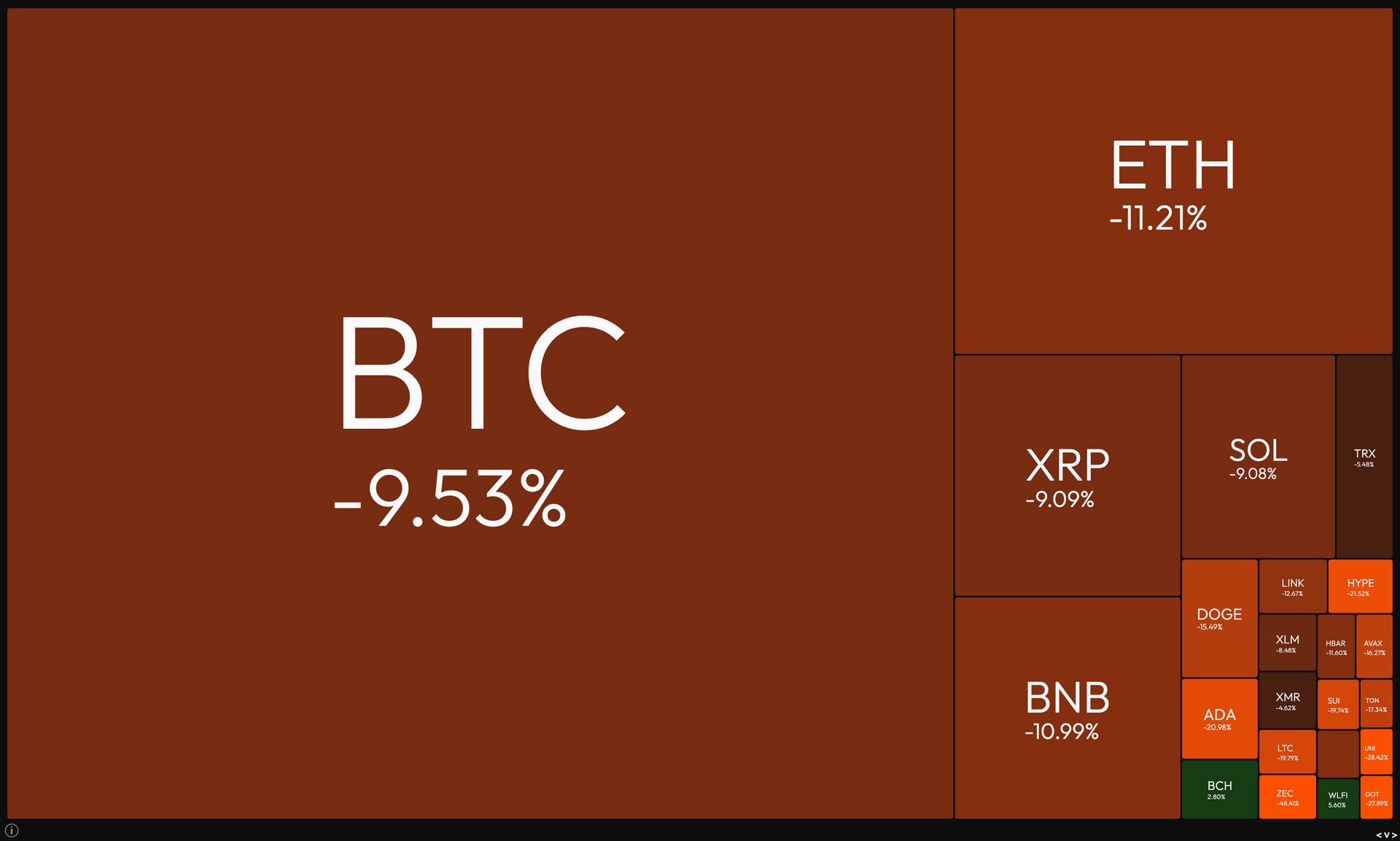

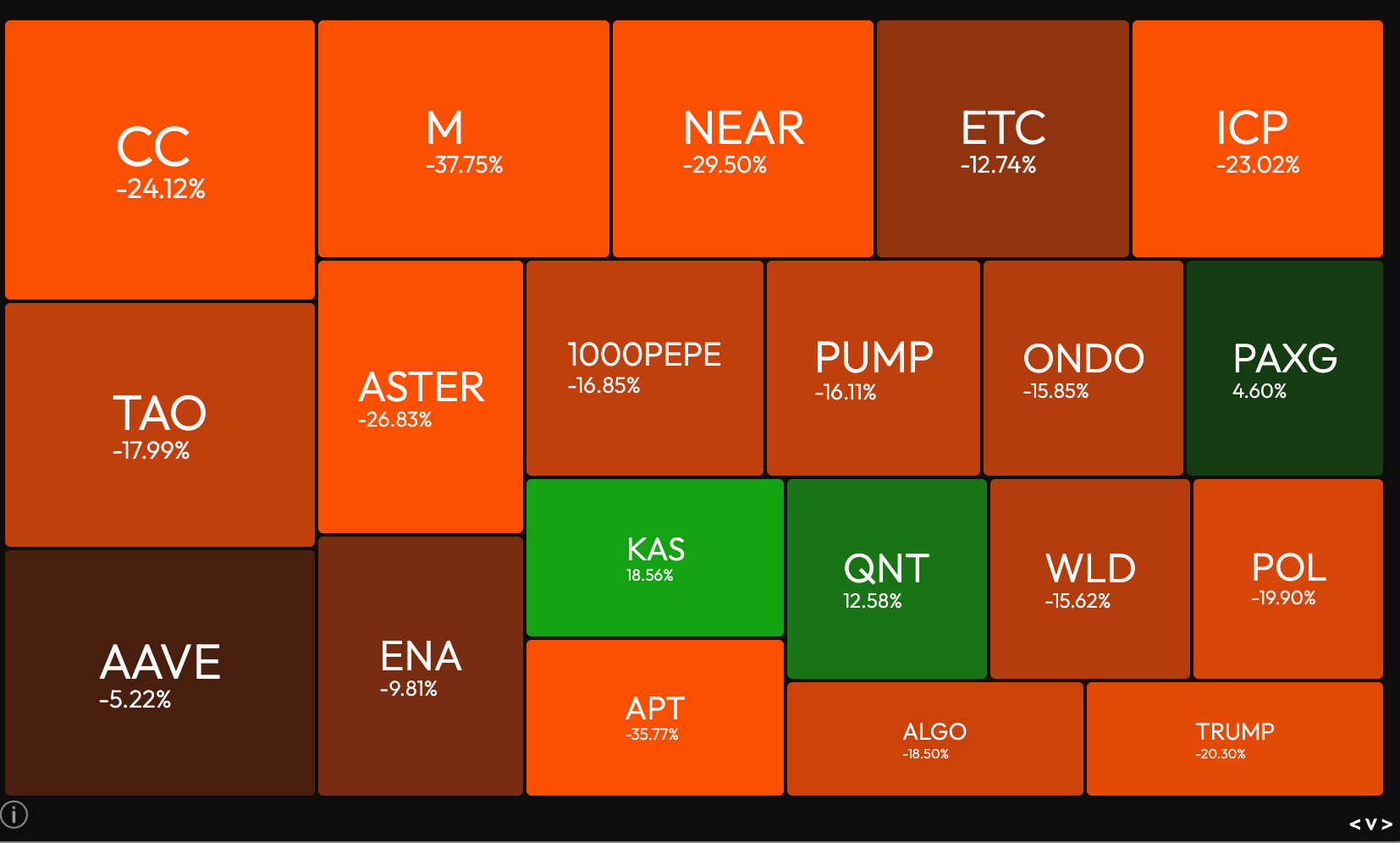

In a sea of red, only a few green spots remain. Over the past two weeks, we've been getting obliterated. Since October, we've been caught in a relentless downturn, and with today's news from the BOJ (Bank of Japan) and Saylor, we're staring down yet another brutal red day.

The biggest and most interesting development for me today is Saylor coming out and saying that if they fall below MNAV, they'll sell BTC or BTC-linked derivatives. This is the first time the narrative has shifted from WE WILL NEVER SELL to WE MIGHT HAVE TO SELL. Why would they become forced sellers? Simple… debt obligations and dividends need to be paid. Saylor is a smart cookie, but nobody is marked safe in this game. His ability to raise money over and over only works when BTC is climbing. When it's falling, it's a completely different game. Sure, there are plenty of options like debt restructuring, but that would be the nuclear option, the last resort.

Note: We haven't even gone below Saylor's average buy price… and we already know he doesn't become a instant forced seller or instantly liquidated as price passes that, but it is a major level for BTC and its market participants. A lot of fellas going to lose hope if this happens.

So where does that leave us? Looking back, we've had an insane run, and a 30% correction in BTC during a bull run is actually quite common. The real issue is that most of CT isn't sitting comfortably in BTC and stables. They've been hypergambling, mega-leveraging perps on altcoins, and getting rinsed over and over again. Maybe we should go back to the Bitmex days with coin margin to build up a new generation of traders who actually survive.

I tried pulling up charts and data to put a positive spin on our coins, to make them look better somehow. But honestly, just look at the year we've had. Even Dyme's silver is at ATH, up 100% YTD, absolutely blowing our coins out of the water YTD. Of course, every market has its rotation, its moment in the sun, but crypto has been getting the short end of the stick these last few months.

Maybe, as always, we're front-running the rest of the markets to the downside. But if this was supposed to be a bull run, then wow. Pathetic. A bull run for BTC alone, while ETH never even touched ATH and has traded at the same price for five years. Even with all the institutional inflows and mainstream spotlight, we’re sitting at the current levels. But as with all emerging markets, our time will eventually come again.

Last note, Even the guy who put on that mega December Santa Rally 100-106-112-118k Call Condor is getting smoked right now. His initial payoff is 11:1, he needs a 106-112k range to cash… Pray for our options brother.

Charts from Velo Data: https://velo.xyz

Twitter/X: https://x.com/velo_xyz

Greeks.live Marketplace Block Trades

To Join Greekslive Block Marketplace: t.me/GreeksLive

Find Greekslive On Twitter: https://twitter.com/GreeksLive

We are grateful to get a peek into the largest trades provided by Greeks live. These trades were the largest trades blocked on greeks live this past week. Nothing crazy stands out with mega mega size. But these put buyers on the left side are all in the winners column now! Price has continued to freefall, and some of the smart money cashed in big this week.

Wrap-up

My thesis that this is a bull run for BTC only still stands.

Alts have been crushed to obliteration, and ETH is the same price it was five years ago. I saw a smart fella on CT comparing ETH to Amazon, noting how Amazon was flat for 10 years, but let's not compare crypto chains to enterprise-level companies. They do vastly different things. Let's not compare them like that… ever…

Despite the red candles, I still believe buying spot BTC is reasonable, and generally speaking, buying when others are panicking works well if you have a longer time horizon. There's still hope for crypto, but maybe it isn't what we always imagined it would be. I'm all eyes on people's theses and views for the future of crypto, but currently it's looking like BTC only, while stablecoins run (or ruin) the world.

The goal was always to sell your coins to the institutions…. Well, we had our chance at $125k. Best of luck to all traders. See you in two weeks, and see you in the Kyan Orderbooks!

Recap:

Stage 2 On Kyan Testnet Starts Today!

Put Buyers Cashed Big

Sea Of Red

Trade on Kyan: https://alpha.kyan.blue/

Join The Marty Community Telegram: https://t.me/optionswithmarty

Mind you there is never a paid group, all information is free and we will never ask you for money. The Telegram is always free and provides a community for people to chat and learn.

What Does Kyan Mean for Crypto Options?

Kyan will be a significant upgrade for anyone trading decentralized derivatives.