Onchain derivatives have grown fast, but they’ve grown unevenly. Perpetual futures scaled first because they were easy to build and easy to understand. Options came later, fragmented across chains and designs that prioritized safety over usability. What emerged was not a complete market, but a collection of partial solutions.

For traders, this means compromises. You can trade perps with leverage, but you can’t easily hedge them with options. You can trade options, but only by overcollateralizing and managing each position in isolation. Portfolio risk is broken into pieces the system doesn’t recognize as related.

Centralized exchanges solved this by designing around portfolios instead of products. DeFi mostly hasn’t.

Kyan is needed because it starts from that missing layer: a derivatives system built around how risk actually behaves, not around what was easiest to deploy onchain.

Don’t forget to sign up for updates on upcoming Kyan events.

The Gap Between DeFi and How Traders Actually Trade

Onchain derivatives platforms largely evolved around what was easiest to ship, not what traders actually needed. Early designs prioritized isolated margin systems, single-product trading, and conservative risk assumptions that evaluate each position as if it exists independently from the rest of the portfolio. This approach simplified engineering and reduced systemic risk, but it also imposed an artificial view of how trading works in practice.

Isolated Margin

That model can be sufficient for users placing straightforward, directional bets. If you are simply long or short a single market, treating each position in isolation produces predictable and manageable outcomes. However, the limitations become obvious as soon as a trader attempts to manage risk across multiple instruments or build structured positions. Hedging loses its effectiveness, capital becomes unnecessarily locked, and the system discourages the use of more advanced strategies by design.

In traditional markets, traders think in terms of exposures rather than individual positions. A short futures contract is not just a separate trade from a long options position; it is part of a combined risk profile. A spread carries meaningfully less risk than either leg on its own because the relationship between those legs defines the true exposure. Capital efficiency emerges from understanding how positions interact and offset each other within a portfolio.

Read more about capital efficiency in this article.

Kyan was designed around this reality from the start. Instead of assuming every trade must stand alone, it evaluates risk at the portfolio level and allows margin requirements to reflect the actual structure of a trader’s positions. By modeling relationships between instruments, Kyan aligns onchain trading with how risk is managed in professional markets, unlocking better capital efficiency and more accurate risk control without forcing traders to oversimplify their strategies.

Portfolio Margin as a First Principle

Portfolio margin is often described as just another feature. At Kyan, it is the foundation the entire system is built on. From the beginning, the platform was designed around the idea that risk does not exist at the level of a single trade, but across the full set of positions a trader holds at any given time.

Portfolio Margin on Kyan

Instead of forcing users to fully collateralize each position in isolation, Kyan evaluates risk across the entire portfolio. Offsetting exposures are recognized, correlated positions are modeled as such, and hedging strategies reduce margin requirements in a meaningful way.

The practical result is lower capital requirements and significantly greater flexibility. Traders are able to construct multi-leg strategies without constantly moving funds between accounts or closing positions simply to free up margin. Capital can stay deployed where it is most effective, not trapped behind rigid risk assumptions that do not reflect real exposure.

This shift changes the nature of onchain trading itself. Instead of encouraging isolated speculation, it enables true risk management. Positions become parts of a coherent strategy and margin becomes a tool for expressing structured views. In that sense, portfolio margin is not just a capability Kyan offers, but the difference between trading around limitations and trading with intent.

Read more about Kyan’s portfolio margin system here.

Perps and Options Under One Roof

One of the structural mistakes in onchain derivatives has been treating perps and options as if they belong to different universes. In reality, traders rarely think of them that way. Perps are used to express directional views and hedge delta. Options are used to manage convexity, volatility, and tail risk. They are different instruments, but they are parts of the same toolkit.

When those instruments live on different platforms, with different margin systems and disconnected liquidity, traders are forced into compromises:

Hedging becomes more expensive than it should be.

Capital gets stranded in multiple accounts.

Execution becomes fragmented.

Strategies that work smoothly in traditional markets turn into awkward, multi-step processes onchain.

Kyan removes that separation by bringing perps and options under the same hood. They share margin, risk modeling, and liquidity. The system understands how positions relate to one another. This makes strategies that were previously impractical onchain suddenly viable, because the infrastructure finally supports how traders actually operate.

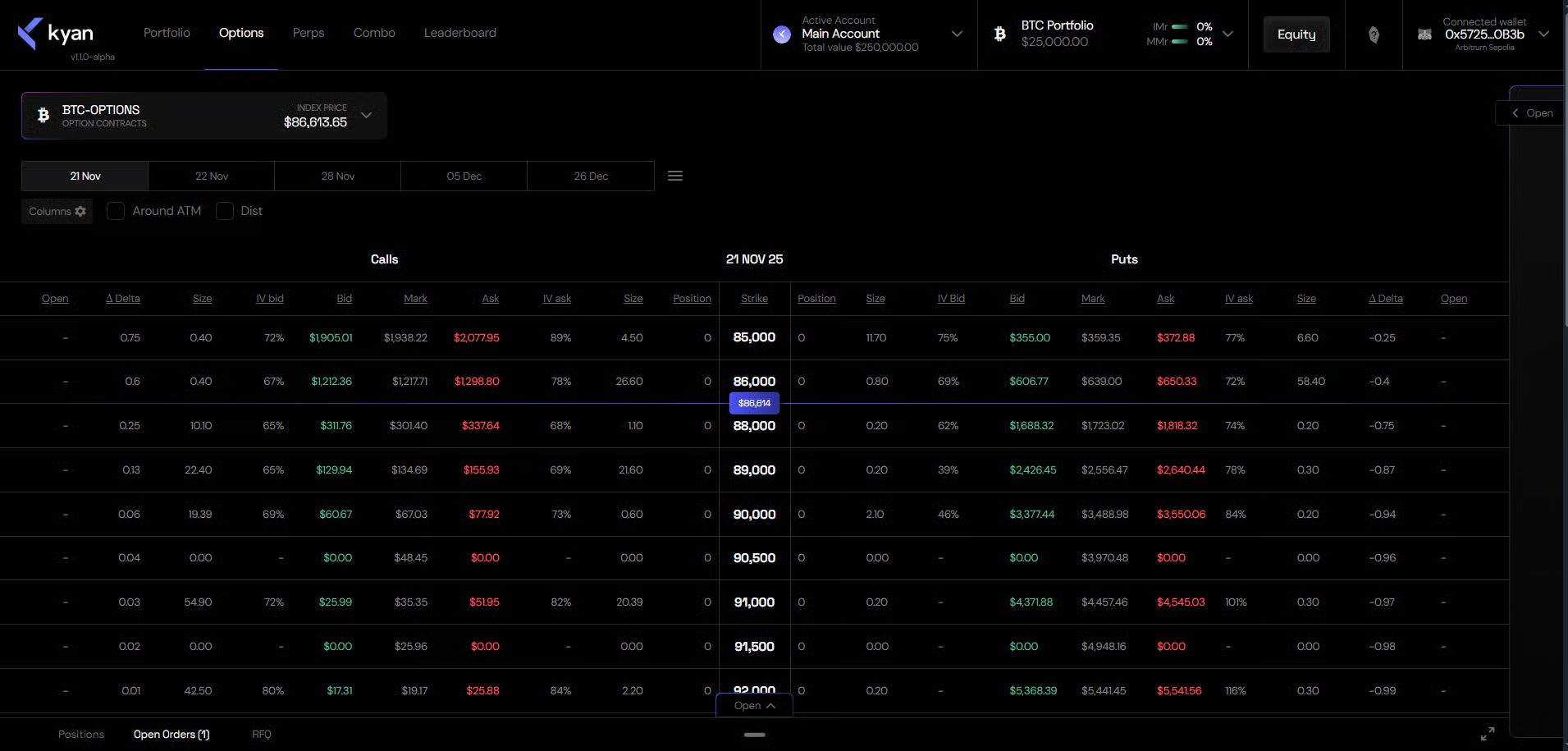

Options on Kyan

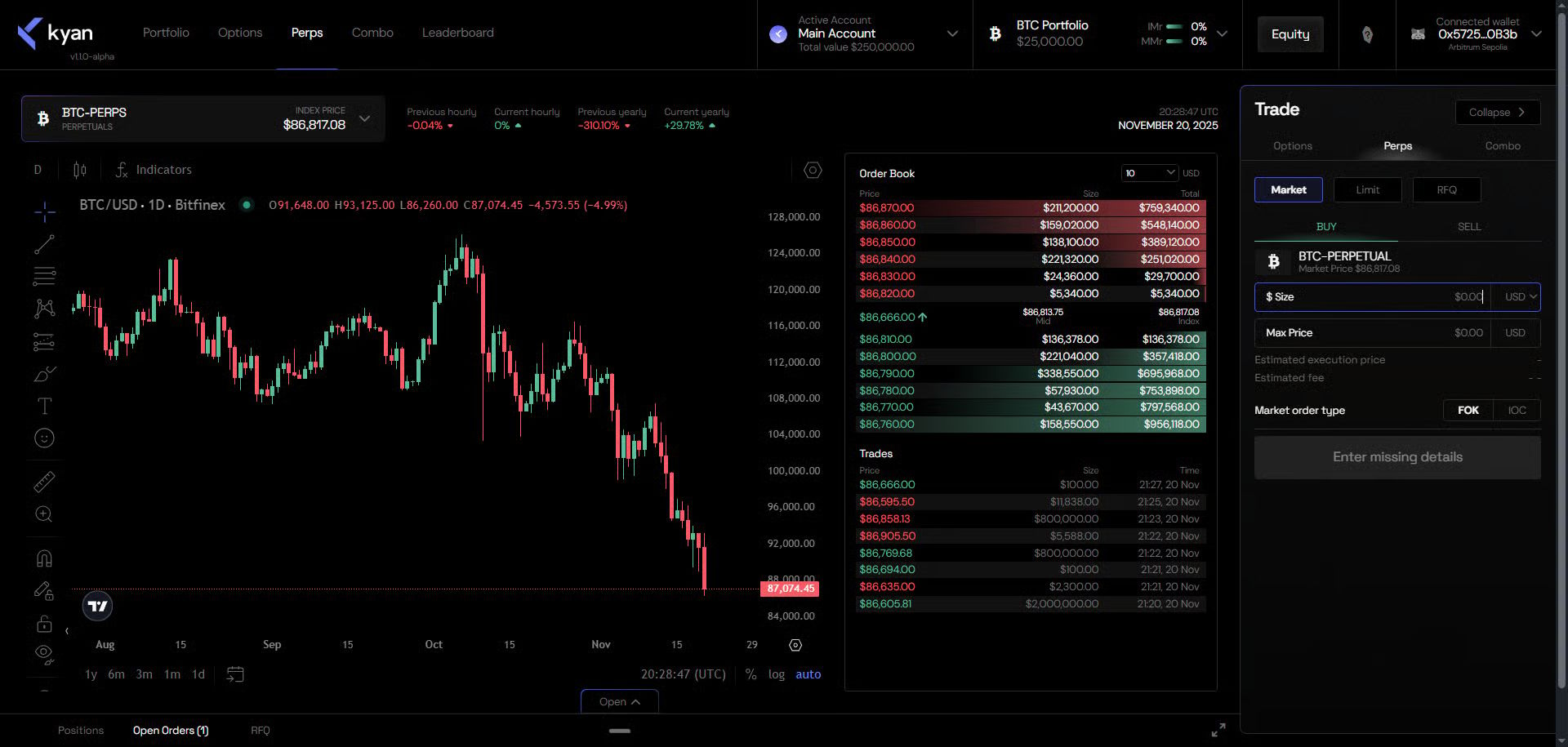

Perps on Kyan

Making Advanced Strategies Viable Onchain

Onchain options did not struggle because traders lacked interest. They struggled because execution was unforgiving.

Manually legging into spreads introduces timing risk. Fully collateralized models lock up far more capital than the strategy itself requires. Liquidity thins out quickly once you move beyond the largest assets. Each of these frictions compounds, turning what should be routine strategies into high-effort exercises with poor risk-adjusted outcomes.

Kyan approaches this problem from the trader’s perspective:

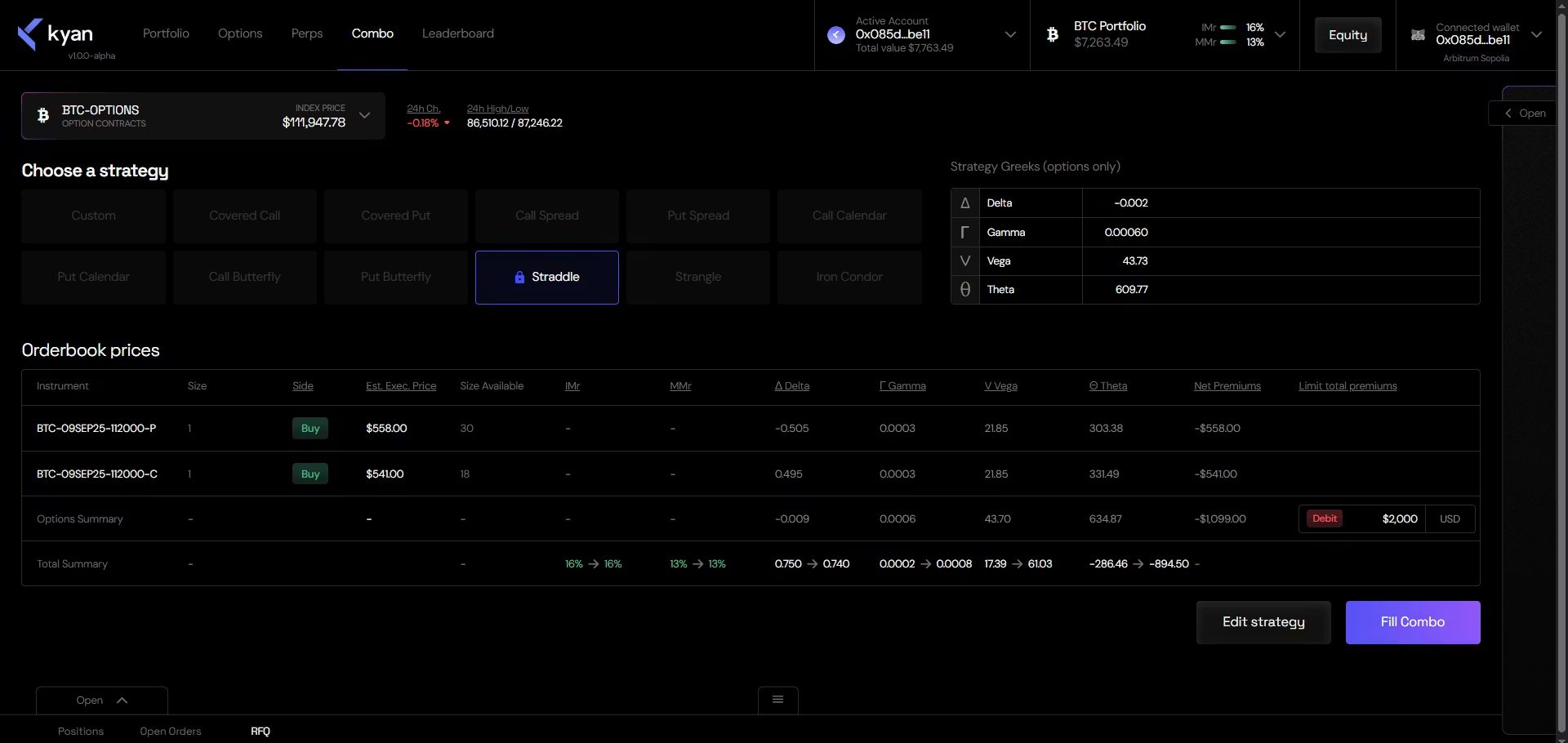

Multi-leg strategies can be executed atomically, removing leg risk.

Margin is assessed across the entire portfolio, rather than position by position.

Capital is deployed where it actually contributes to exposure, instead of being parked as redundant collateral.

Combo Trades on Kyan

The objective is to make the strategies traders already understand and rely on workable in a self-custodial environment, without forcing them to accept worse execution or distorted risk.

Read more about combo trades on Kyan in this article.

Seamless Experience or Control? You Can Have Both!

For years, “self-custody” in crypto has been synonymous with friction. Wallet pop-ups interrupting every action, transactions failing because the wrong network was selected, gas fees that need to be calculated and reloaded at the worst possible time, and funds that feel one mistake away from being lost. What was meant to represent sovereignty often ended up feeling like constant operational overhead.

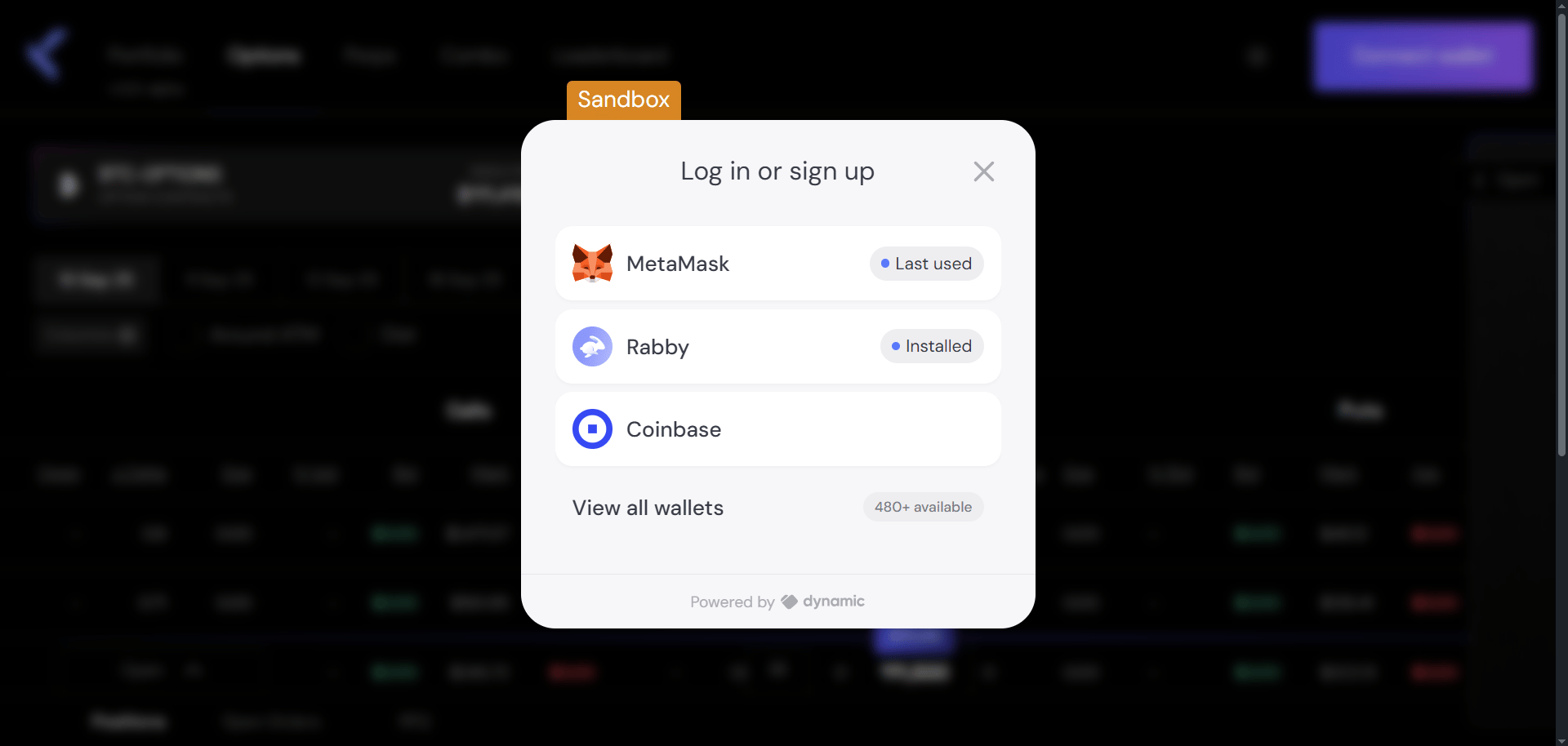

Kyan starts from a different premise: control should not require complexity. The platform is built so that users can onboard and begin trading without ever touching a browser wallet, switching networks, or thinking about gas. The mechanics of being onchain are handled in the background, allowing the experience to feel closer to a modern trading interface than a sequence of blockchain rituals.

Onboarding on Kyan

At the same time, abstraction does not come at the cost of ownership. Those who want full self-custody can keep it, transparently and verifiably, with their positions and balances secured by their own keys. The system lowers the barrier to entry for new users while preserving the guarantees that experienced traders care about.

Why This Matters Now

The onchain derivatives market is no longer experimental. Volumes are real, participants are sophisticated, and expectations have changed. Traders are not asking whether DeFi can support derivatives at all. They are asking why it still fails to support serious trading. Kyan is built for that inflection point.

Instead of forcing traders to reshape their strategies to fit rigid protocol constraints, Kyan reshapes the protocol around how traders already think about risk, hedging, and capital. It treats portfolios as portfolios, not collections of unrelated positions. It makes complex strategies practical without sacrificing self-custody or market integrity.

That is why Kyan is needed. And it is why Kyan is positioned to become foundational infrastructure for onchain derivatives, not just another place to trade.

What Does Kyan Mean for Crypto Options?

Kyan will be a significant upgrade for anyone trading decentralized derivatives.